Copy to clipboard

Copy to clipboard

Eric Muehlbauer, Executive Director and CEO of NASS, sits in an interesting position in the spine industry in that he serves multiple stakeholders, from surgeons to device companies, to suppliers and service providers, around the globe. In speaking with him about NASS’ priorities, as well as where the greatest opportunities lie for surgeons and device companies, three topics arose.

INTERNATIONAL EXPANSION

Growing the spine industry in international markets is a NASS priority for the remainder of 2016 and into 2017. This is taking shape through nearly 20 programs outside of the U.S., mainly in Asia. NASS has built partnerships with local groups to offer educational programming and training to surgeons, and to introduce U.S. manufacturers to these markets through exhibitions. A recent hands-on course produced with the Chinese Association of Orthopaedic Surgeons attracted attendance of 1,500 watching in the auditorium and 30,000 online. Recent and future countries where you’ll find NASS include Egypt, China, India, Indonesia, Lebanon and Germany. You can also expect this reach to result in more international companies and surgeons attending the NASS Annual Meeting in 2016 and beyond.

MINIMALLY INVASIVE SURGERY

Regarding clinical practice, surgeons’ greatest opportunities lie in minimally invasive techniques, Muehlbauer says. Reimbursement schemes will push surgeons to adopt MIS techniques and tools.

This has led NASS to prioritize the minimally invasive market by targeting companies that offer minimally invasive tools to exhibit at its meetings.

When we asked spine surgeons to identify technology that had the most potential to advance the specialty, their list was topped by minimally invasive technology, instrumentation and techniques. Surgeons cited the same reasons that payors often do: the benefits of shorter hospital stay, faster recovery time and the ability to perform surgery in the outpatient setting.

DEVICE COMPANY PRODUCT PORTFOLIOS

The greatest opportunities for spine companies lie in their ability to expand their breadth of products, Muehlbauer says. If you’re able to walk into a health system with everything from the latest plate and rod to the best pain medication to the newest robot, you’ve greatly improved your chances to be a vendor by simplifying the transaction.

As a companion to Muehlbauer’s points, we offer the financial perspective. Some companies are exercising the strategies mentioned herein, while others are realizing success from different approaches.

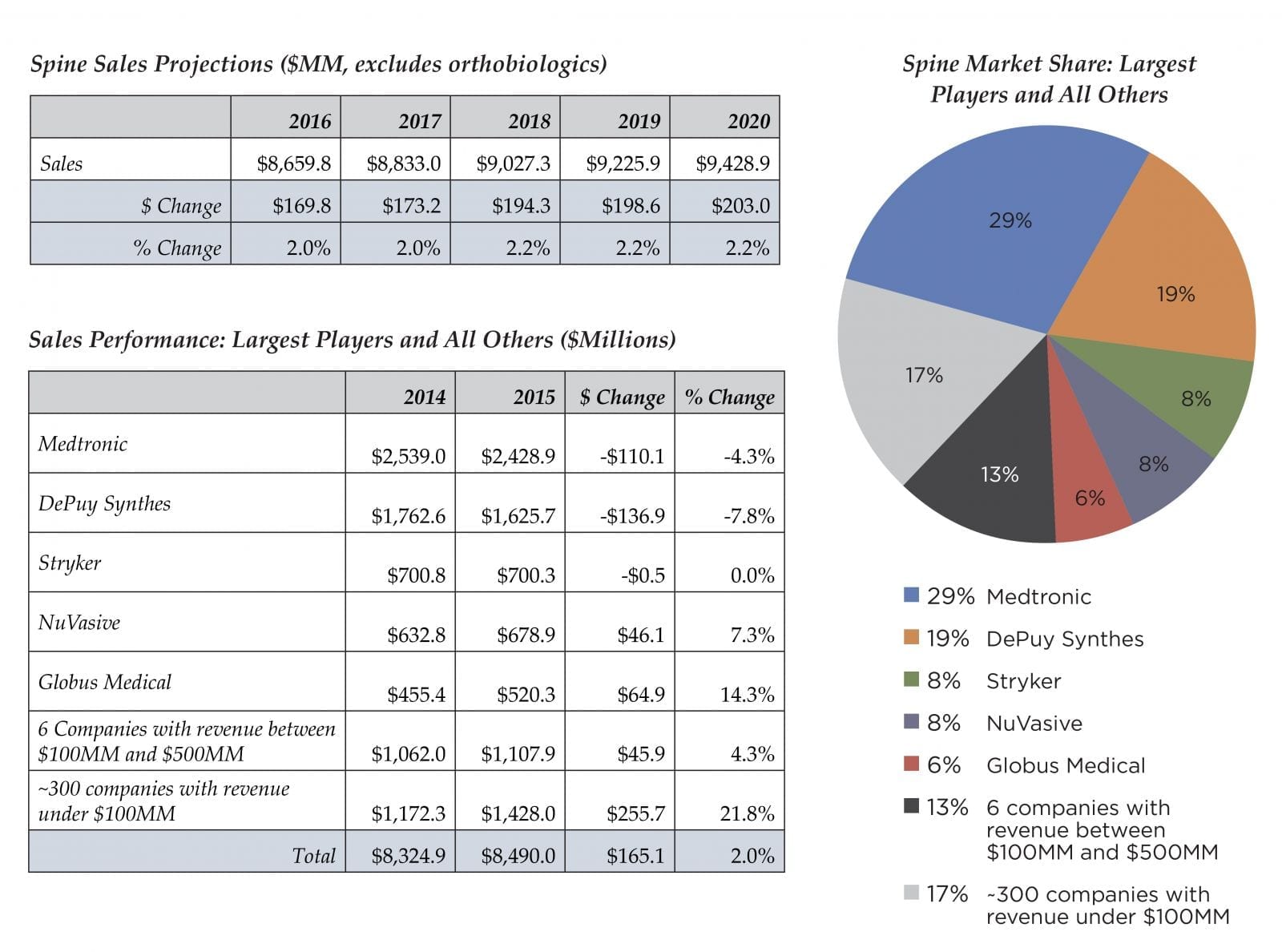

- Medtronic, DePuy Synthes and Stryker claim top market share, but their spine sales through 2015 have been flat/eroding. We predict a return to growth but in the interim, due to their sheer size, the overall market just can’t move by more than a percent or two.

- Pure-play spine companies and those with lower annual revenues are growing at a rate that exceeds the overall market. For instance, per our estimates, the ~300 companies with revenue under $100MM together realized 22% (+$255.7MM) YOY growth in 2015.

Here are the numbers from spine as excerpted from THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT®.

Learn from your competitors, customers and peers by reading the spine chapter of your Annual Report.

Eric Muehlbauer, Executive Director and CEO of NASS, sits in an interesting position in the spine industry in that he serves multiple stakeholders, from surgeons to device companies, to suppliers and service providers, around the globe. In speaking with him about NASS’ priorities, as well as where the greatest opportunities lie for surgeons...

Eric Muehlbauer, Executive Director and CEO of NASS, sits in an interesting position in the spine industry in that he serves multiple stakeholders, from surgeons to device companies, to suppliers and service providers, around the globe. In speaking with him about NASS’ priorities, as well as where the greatest opportunities lie for surgeons and device companies, three topics arose.

INTERNATIONAL EXPANSION

Growing the spine industry in international markets is a NASS priority for the remainder of 2016 and into 2017. This is taking shape through nearly 20 programs outside of the U.S., mainly in Asia. NASS has built partnerships with local groups to offer educational programming and training to surgeons, and to introduce U.S. manufacturers to these markets through exhibitions. A recent hands-on course produced with the Chinese Association of Orthopaedic Surgeons attracted attendance of 1,500 watching in the auditorium and 30,000 online. Recent and future countries where you’ll find NASS include Egypt, China, India, Indonesia, Lebanon and Germany. You can also expect this reach to result in more international companies and surgeons attending the NASS Annual Meeting in 2016 and beyond.

MINIMALLY INVASIVE SURGERY

Regarding clinical practice, surgeons’ greatest opportunities lie in minimally invasive techniques, Muehlbauer says. Reimbursement schemes will push surgeons to adopt MIS techniques and tools.

This has led NASS to prioritize the minimally invasive market by targeting companies that offer minimally invasive tools to exhibit at its meetings.

When we asked spine surgeons to identify technology that had the most potential to advance the specialty, their list was topped by minimally invasive technology, instrumentation and techniques. Surgeons cited the same reasons that payors often do: the benefits of shorter hospital stay, faster recovery time and the ability to perform surgery in the outpatient setting.

DEVICE COMPANY PRODUCT PORTFOLIOS

The greatest opportunities for spine companies lie in their ability to expand their breadth of products, Muehlbauer says. If you’re able to walk into a health system with everything from the latest plate and rod to the best pain medication to the newest robot, you’ve greatly improved your chances to be a vendor by simplifying the transaction.

As a companion to Muehlbauer’s points, we offer the financial perspective. Some companies are exercising the strategies mentioned herein, while others are realizing success from different approaches.

- Medtronic, DePuy Synthes and Stryker claim top market share, but their spine sales through 2015 have been flat/eroding. We predict a return to growth but in the interim, due to their sheer size, the overall market just can’t move by more than a percent or two.

- Pure-play spine companies and those with lower annual revenues are growing at a rate that exceeds the overall market. For instance, per our estimates, the ~300 companies with revenue under $100MM together realized 22% (+$255.7MM) YOY growth in 2015.

Here are the numbers from spine as excerpted from THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT®.

Learn from your competitors, customers and peers by reading the spine chapter of your Annual Report.

You are out of free articles for this month

Subscribe as a Guest for $0 and unlock a total of 5 articles per month.

You are out of five articles for this month

Subscribe as an Executive Member for access to unlimited articles, THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT and more.

CL

Carolyn LaWell is ORTHOWORLD's Chief Content Officer. She joined ORTHOWORLD in 2012 to oversee its editorial and industry education. She previously served in editor roles at B2B magazines and newspapers.