Copy to clipboard

Copy to clipboard

Genstar Capital sold Tecomet, a global supplier of high-precision manufacturing solutions for complex tight-tolerance products, to previous owner Charlesbank Capital Partners.

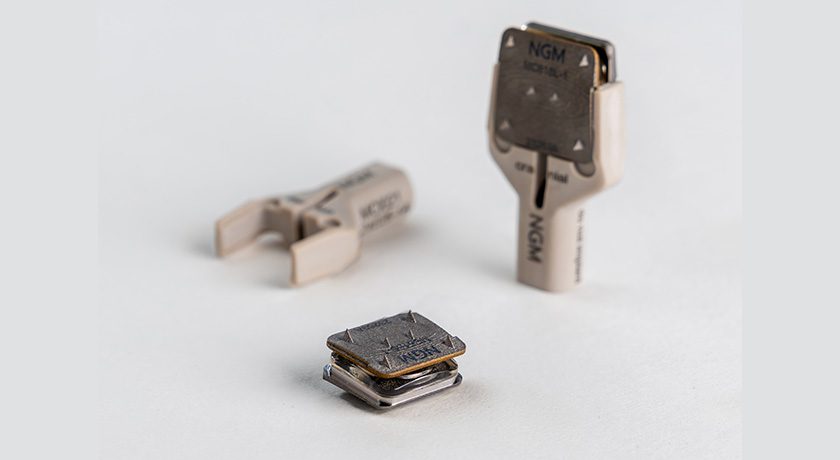

Founded in 1964, Tecomet specializes in forged, cast and machined orthopaedic implants, instruments, sterilization cases/trays and photochemically etched products, and also offers Tecomet Standard Products, the LaunchQuick™ Process Development Center and Total Solutions® to manage all parts of a product launch cycle. The company employs a staff of 2,800 worldwide at 15 facilities, equalling ~1 million square feet of space, and serves all of the top five orthopaedic device companies as well as rising performers like Lima Corporate, manufacturing devices for joint reconstruction, spine, trauma, arthroscopy and CMF. It is among the largest orthopaedic device contract manufacturers in the world.

Charlesbank Capital had acquired Tecomet from Cardinal Health in 2008, which sold it to Genstar at the end of 2013. During 2014, Tecomet completed acquisitions of Symmetry Medical’s OEM Solutions segment and 3D Medical Manufacturing, establishing a strong ex-U.S. presence; at the time, the purchase of Symmetry Medical alone added 18 facilities in five countries on three continents. Overall, we estimate that acquisitions effectively quadrupled Tecomet’s revenue by the end of 2014. In 2015, Tecomet reported organic growth at an excess of 10% over the previous six years and affirmed its intent to continue acquisitions outside of its capabilities. Subsequently, the company bought Mountainside Medical in late 2016, supporting a strategic priority to lead in the minimally invasive market.

In prepared remarks, Mark Kemp, Chief Executive Officer of Tecomet, said, “Genstar’s partnership with Tecomet and their involvement was invaluable as the company significantly repositioned itself into one of the world’s largest solutions providers to the medical device and aerospace & defense industries. With Genstar’s strategic support and financial resources, we meaningfully increased our product offering, expanded our geographic reach into Europe and Asia Pacific and commercialized our unique proprietary technologies. Working in concert with Genstar to implement a dynamic growth plan, Tecomet transformed into a stronger global competitor and there are numerous avenues to continue this exceptional track record of growth in the medical device and aerospace & defense end markets.”

William Blair & Company was lead financial advisor to Tecomet for the transaction.

Sources: Genstar Capital; ORTHOWORLD Inc./BONEZONE®

Tecomet’s M&A Timeline

- May 2017: Acquired by Charlesbank Capital

- December 2016: Bought Mountainside Medical, manufacturer of components and instruments for minimally invasive surgery as well as orthopaedic and neurosurgical and implants and instruments

- December 2014: Completed acquisition of Symmetry Medical’s OEM Solutions business, which had been announced in August 2014. This $450MM acquisition created the largest orthopaedic contract manufacturer in the world, with 18 facilities in five countries on three continents. OEM Solutions was a manufacturer of precision surgical instruments, orthopaedic implants and sterilization cases and trays.

- August 2014: Acquired 3D Medical Manufacturing, contract manufacturer of medical device components, implants, instruments, cutting tools and mechanical/electro-mechanical assemblies.

- December 2013: Tecomet bought by Genstar Capital Management

- August 2012: Completed its $45.2MM acquisition of the OEM Orthopedics business of Teleflex. Product lines included Beere Medical’s custom surgical instruments and SMD (Specialized Medical Devices) micro-machined products (plates, screws, rods, etc.).

- July 2011: Acquired Kemac Technology, provider of services such as Nitinol etching, Nitinol shape-setting and stainless steel etching.

- August 2008: Tecomet was acquired from Cardinal Health by Charlesbank Capital.

- May 2007: Cardinal Health acquired Viasys Healthcare for $1.5 billion. At the time, Viasys’ orthopaedic manufacturing business included Tecomet.

Genstar Capital sold Tecomet, a global supplier of high-precision manufacturing solutions for complex tight-tolerance products, to previous owner Charlesbank Capital Partners.

Founded in 1964, Tecomet specializes in forged, cast and machined orthopaedic implants, instruments, sterilization cases/trays and photochemically etched products, and...

Genstar Capital sold Tecomet, a global supplier of high-precision manufacturing solutions for complex tight-tolerance products, to previous owner Charlesbank Capital Partners.

Founded in 1964, Tecomet specializes in forged, cast and machined orthopaedic implants, instruments, sterilization cases/trays and photochemically etched products, and also offers Tecomet Standard Products, the LaunchQuick™ Process Development Center and Total Solutions® to manage all parts of a product launch cycle. The company employs a staff of 2,800 worldwide at 15 facilities, equalling ~1 million square feet of space, and serves all of the top five orthopaedic device companies as well as rising performers like Lima Corporate, manufacturing devices for joint reconstruction, spine, trauma, arthroscopy and CMF. It is among the largest orthopaedic device contract manufacturers in the world.

Charlesbank Capital had acquired Tecomet from Cardinal Health in 2008, which sold it to Genstar at the end of 2013. During 2014, Tecomet completed acquisitions of Symmetry Medical’s OEM Solutions segment and 3D Medical Manufacturing, establishing a strong ex-U.S. presence; at the time, the purchase of Symmetry Medical alone added 18 facilities in five countries on three continents. Overall, we estimate that acquisitions effectively quadrupled Tecomet’s revenue by the end of 2014. In 2015, Tecomet reported organic growth at an excess of 10% over the previous six years and affirmed its intent to continue acquisitions outside of its capabilities. Subsequently, the company bought Mountainside Medical in late 2016, supporting a strategic priority to lead in the minimally invasive market.

In prepared remarks, Mark Kemp, Chief Executive Officer of Tecomet, said, “Genstar’s partnership with Tecomet and their involvement was invaluable as the company significantly repositioned itself into one of the world’s largest solutions providers to the medical device and aerospace & defense industries. With Genstar’s strategic support and financial resources, we meaningfully increased our product offering, expanded our geographic reach into Europe and Asia Pacific and commercialized our unique proprietary technologies. Working in concert with Genstar to implement a dynamic growth plan, Tecomet transformed into a stronger global competitor and there are numerous avenues to continue this exceptional track record of growth in the medical device and aerospace & defense end markets.”

William Blair & Company was lead financial advisor to Tecomet for the transaction.

Sources: Genstar Capital; ORTHOWORLD Inc./BONEZONE®

Tecomet’s M&A Timeline

- May 2017: Acquired by Charlesbank Capital

- December 2016: Bought Mountainside Medical, manufacturer of components and instruments for minimally invasive surgery as well as orthopaedic and neurosurgical and implants and instruments

- December 2014: Completed acquisition of Symmetry Medical’s OEM Solutions business, which had been announced in August 2014. This $450MM acquisition created the largest orthopaedic contract manufacturer in the world, with 18 facilities in five countries on three continents. OEM Solutions was a manufacturer of precision surgical instruments, orthopaedic implants and sterilization cases and trays.

- August 2014: Acquired 3D Medical Manufacturing, contract manufacturer of medical device components, implants, instruments, cutting tools and mechanical/electro-mechanical assemblies.

- December 2013: Tecomet bought by Genstar Capital Management

- August 2012: Completed its $45.2MM acquisition of the OEM Orthopedics business of Teleflex. Product lines included Beere Medical’s custom surgical instruments and SMD (Specialized Medical Devices) micro-machined products (plates, screws, rods, etc.).

- July 2011: Acquired Kemac Technology, provider of services such as Nitinol etching, Nitinol shape-setting and stainless steel etching.

- August 2008: Tecomet was acquired from Cardinal Health by Charlesbank Capital.

- May 2007: Cardinal Health acquired Viasys Healthcare for $1.5 billion. At the time, Viasys’ orthopaedic manufacturing business included Tecomet.

You are out of free articles for this month

Subscribe as a Guest for $0 and unlock a total of 5 articles per month.

You are out of five articles for this month

Subscribe as an Executive Member for access to unlimited articles, THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT and more.

JV

Julie Vetalice is ORTHOWORLD's Editorial Assistant. She has covered the orthopedic industry for over 20 years, having joined the company in 1999.