Copy to clipboard

Copy to clipboard

MicroPort Orthopedics reported orthopedic revenue of USD $86.6 million, -23.6% vs. 1H19. With only about 11% of its revenue coming from the domestic Chinese market, the company had significant exposure to COVID-related procedure deferrals in the first half. These deferrals offset better than expected momentum at the beginning of the year. May brought signs of recovery for MicroPort’s global sales, and North America returned to growth by June.

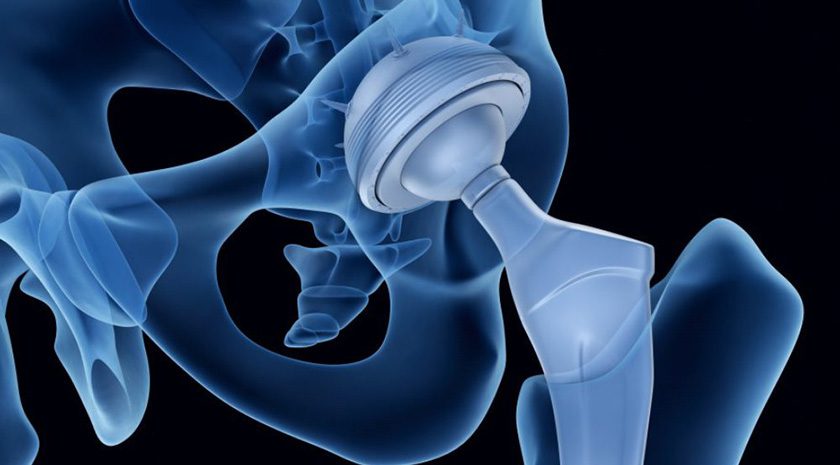

As company sales slowed during the pandemic, MicroPort focused on strengthening its product portfolio by designing, developing and submitting several new products for approval. The GLADIATOR™ cementless femoral stem obtained FDA clearance in the United States. At the same time, the PROCOTYL™ P acetabular cup system and Evolution™ NitrX™ Medial-Pivot Knee received approval under the CE Mark. ICE instruments for supporting the EVOLUTION™ total knee replacement system also launched globally.

In China, the domestically manufactured Goral™ Total Hip system obtained regulatory clearance. Meanwhile, MicroPort’s spine and trauma sales in China benefitted from the launches of the Piscis™II Interbody Fusion system and the Tankin™II Canulated Spine MIS system.

MicroPort’s orthopedic business raised RMB 580 million (USD $82 million) from investors in the first half, which will provide the necessary funding to support the company’s new product development and market expansion efforts.

Revenue Data

All revenue data is provided in USD millions unless otherwise noted. Sales and growth rates are estimated on an as-reported basis.

Segment Sales

| 1H20 | 1H19 | $ Chg | % Chg | |

|---|---|---|---|---|

| Joint Replacement | $73.6 | $101.0 | ($27.3) | (27.1%) |

| Knees | $30.3 | $42.0 | ($11.7) | (27.8%) |

| Hips | $43.3 | $59.0 | ($15.7) | (26.6%) |

| Spine | $4.3 | $4.5 | ($0.2) | (4.5%) |

| Trauma | $8.7 | $7.9 | $0.7 | 9.1% |

| Total | $86.6 | $113.4 | ($26.8) | (23.6%) |

Geographic Sales

| 1H20 | 1H19 | $ Chg | % Chg | |

|---|---|---|---|---|

| US | $36.4 | $45.1 | ($8.7) | (19.2%) |

| OUS | $50.2 | $68.3 | ($18.2) | (26.6%) |

| EMEA | $15.9 | $29.1 | ($13.2) | (45.5%) |

| Asia Pacific | $26.7 | $29.3 | ($2.6) | (9%) |

| Rest of World | $7.6 | $9.9 | ($2.3) | (23%) |

| Total | $86.6 | $113.4 | ($26.8) | (23.6%) |

Earnings

| Amt | % of Sales | |

|---|---|---|

| Sales | $306.9 | |

| Cost of Sales | $89.3 | 29.1% |

| Selling and Admin | $202.6 | 66% |

| R&D | $72.8 | 23.7% |

| Other | $11.0 | 3.6% |

| Net Earnings | ($68.8) | (22.4%) |

Mike Evers is ORTHOWORLD’s Digital Content Strategist. He can be reached by email.

MicroPort Orthopedics reported orthopedic revenue of USD $86.6 million, -23.6% vs. 1H19. With only about 11% of its revenue coming from the domestic Chinese market, the company had significant exposure to COVID-related procedure deferrals in the first half. These deferrals offset better than expected momentum at the beginning of the year....

MicroPort Orthopedics reported orthopedic revenue of USD $86.6 million, -23.6% vs. 1H19. With only about 11% of its revenue coming from the domestic Chinese market, the company had significant exposure to COVID-related procedure deferrals in the first half. These deferrals offset better than expected momentum at the beginning of the year. May brought signs of recovery for MicroPort’s global sales, and North America returned to growth by June.

As company sales slowed during the pandemic, MicroPort focused on strengthening its product portfolio by designing, developing and submitting several new products for approval. The GLADIATOR™ cementless femoral stem obtained FDA clearance in the United States. At the same time, the PROCOTYL™ P acetabular cup system and Evolution™ NitrX™ Medial-Pivot Knee received approval under the CE Mark. ICE instruments for supporting the EVOLUTION™ total knee replacement system also launched globally.

In China, the domestically manufactured Goral™ Total Hip system obtained regulatory clearance. Meanwhile, MicroPort’s spine and trauma sales in China benefitted from the launches of the Piscis™II Interbody Fusion system and the Tankin™II Canulated Spine MIS system.

MicroPort’s orthopedic business raised RMB 580 million (USD $82 million) from investors in the first half, which will provide the necessary funding to support the company’s new product development and market expansion efforts.

Revenue Data

All revenue data is provided in USD millions unless otherwise noted. Sales and growth rates are estimated on an as-reported basis.

Segment Sales

| 1H20 | 1H19 | $ Chg | % Chg | |

|---|---|---|---|---|

| Joint Replacement | $73.6 | $101.0 | ($27.3) | (27.1%) |

| Knees | $30.3 | $42.0 | ($11.7) | (27.8%) |

| Hips | $43.3 | $59.0 | ($15.7) | (26.6%) |

| Spine | $4.3 | $4.5 | ($0.2) | (4.5%) |

| Trauma | $8.7 | $7.9 | $0.7 | 9.1% |

| Total | $86.6 | $113.4 | ($26.8) | (23.6%) |

Geographic Sales

| 1H20 | 1H19 | $ Chg | % Chg | |

|---|---|---|---|---|

| US | $36.4 | $45.1 | ($8.7) | (19.2%) |

| OUS | $50.2 | $68.3 | ($18.2) | (26.6%) |

| EMEA | $15.9 | $29.1 | ($13.2) | (45.5%) |

| Asia Pacific | $26.7 | $29.3 | ($2.6) | (9%) |

| Rest of World | $7.6 | $9.9 | ($2.3) | (23%) |

| Total | $86.6 | $113.4 | ($26.8) | (23.6%) |

Earnings

| Amt | % of Sales | |

|---|---|---|

| Sales | $306.9 | |

| Cost of Sales | $89.3 | 29.1% |

| Selling and Admin | $202.6 | 66% |

| R&D | $72.8 | 23.7% |

| Other | $11.0 | 3.6% |

| Net Earnings | ($68.8) | (22.4%) |

Mike Evers is ORTHOWORLD’s Digital Content Strategist. He can be reached by email.

You are out of free articles for this month

Subscribe as a Guest for $0 and unlock a total of 5 articles per month.

You are out of five articles for this month

Subscribe as an Executive Member for access to unlimited articles, THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT and more.

ME

Mike Evers is a Senior Market Analyst and writer with over 15 years of experience in the medical industry, spanning cardiac rhythm management, ER coding and billing, and orthopedics. He joined ORTHOWORLD in 2018, where he provides market analysis and editorial coverage.