Copy to clipboard

Copy to clipboard

Update, 1/4/21: Integra and Smith+Nephew announced completion of this transaction.

Integra Lifesciences announced a definitive agreement to divest its Extremity Orthopedics business to Smith+Nephew for $240 million in cash. In connection with the transaction, Integra will pay $41.5 million to the Consortium of Focused Orthopedists (CFO) relating to agreements between Integra and CFO for the development of shoulder replacement products. Integra anticipates that the deal will close at or near the end of 2020 and not materially impact financial results for the year.

Integra’s Extremity Orthopedics business generated $90 million in 2019 and $32.7 million in 1H20 sales, but the company struggled to get it on track in recent years. Sales declined in the three consecutive years between 2017 and 2019. COVID’s cancellation of elective procedures significantly impacted the business as well, with a -26.6% decline in 1H20 compared to the prior year. For 3Q20, the company expects declines between -5% and -15%.

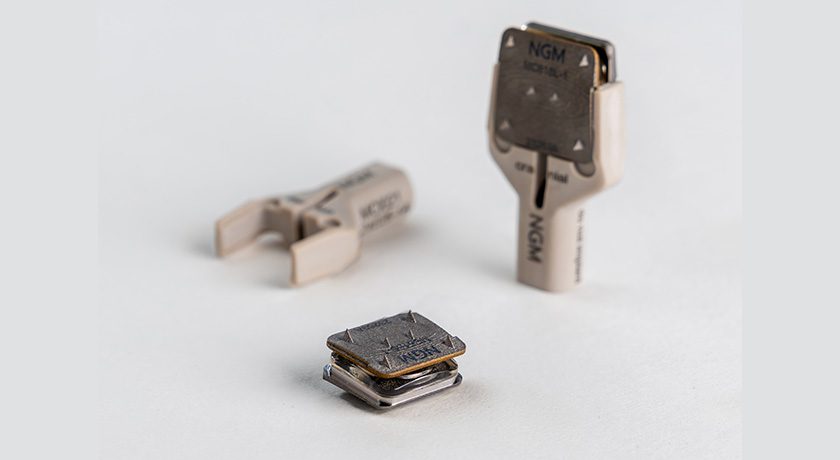

Smith+Nephew gains entry into the shoulder and ankle replacement segments through the transaction. The full portfolio includes devices, implants and instruments for shoulder replacement as well as hand, wrist, elbow, foot and ankle reconstruction. The Extremity Orthopedics R&D pipeline includes a next-generation shoulder replacement system with a 2022 commercial launch date.

The transaction complements SNN’s existing focus on ASC/outpatient settings, and may partially be a countermove to DJO’s proposed acquisition of Stryker’s STAR total ankle and, more indirectly, Stryker’s purchase of Wright Medical. Despite its size, SNN operates below scale in both trauma and extremities compared to its peers. Through this acquisition, Smith+Nephew expands its portfolio and secures a segment-specialized sales channel in the U.S., Canada and Europe. SNN expects the business to deliver double-digit growth and be slightly dilutive to profit in 2021 and 2022.

Update, 1/4/21: Integra and Smith+Nephew announced completion of this transaction.

Integra Lifesciences announced a definitive agreement to divest its Extremity Orthopedics business to Smith+Nephew for $240 million in cash. In connection with the transaction, Integra will pay $41.5 million to the Consortium of Focused...

Update, 1/4/21: Integra and Smith+Nephew announced completion of this transaction.

Integra Lifesciences announced a definitive agreement to divest its Extremity Orthopedics business to Smith+Nephew for $240 million in cash. In connection with the transaction, Integra will pay $41.5 million to the Consortium of Focused Orthopedists (CFO) relating to agreements between Integra and CFO for the development of shoulder replacement products. Integra anticipates that the deal will close at or near the end of 2020 and not materially impact financial results for the year.

Integra’s Extremity Orthopedics business generated $90 million in 2019 and $32.7 million in 1H20 sales, but the company struggled to get it on track in recent years. Sales declined in the three consecutive years between 2017 and 2019. COVID’s cancellation of elective procedures significantly impacted the business as well, with a -26.6% decline in 1H20 compared to the prior year. For 3Q20, the company expects declines between -5% and -15%.

Smith+Nephew gains entry into the shoulder and ankle replacement segments through the transaction. The full portfolio includes devices, implants and instruments for shoulder replacement as well as hand, wrist, elbow, foot and ankle reconstruction. The Extremity Orthopedics R&D pipeline includes a next-generation shoulder replacement system with a 2022 commercial launch date.

The transaction complements SNN’s existing focus on ASC/outpatient settings, and may partially be a countermove to DJO’s proposed acquisition of Stryker’s STAR total ankle and, more indirectly, Stryker’s purchase of Wright Medical. Despite its size, SNN operates below scale in both trauma and extremities compared to its peers. Through this acquisition, Smith+Nephew expands its portfolio and secures a segment-specialized sales channel in the U.S., Canada and Europe. SNN expects the business to deliver double-digit growth and be slightly dilutive to profit in 2021 and 2022.

You are out of free articles for this month

Subscribe as a Guest for $0 and unlock a total of 5 articles per month.

You are out of five articles for this month

Subscribe as an Executive Member for access to unlimited articles, THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT and more.

ME

Mike Evers is a Senior Market Analyst and writer with over 15 years of experience in the medical industry, spanning cardiac rhythm management, ER coding and billing, and orthopedics. He joined ORTHOWORLD in 2018, where he provides market analysis and editorial coverage.