Copy to clipboard

Copy to clipboard

Medical device outsource manufacturer Integer entered into an agreement to sell its Advanced Surgical and Orthopedics lines (ASO) to MedPlast, a global services provider to the medical device industry, for US $600MM in cash. The transaction is expected to close in 3Q18.

Integer was formerly known as Greatbatch, which included Greatbatch Medical and Lake Region Medical orthopaedic products. In 2016, Greatbatch rebranded under the Integer name.

For 2017, Integer’s ASO plus Portable Medical reporting segment posted revenue of $439.8MM. Of that, ORTHOWORLD estimates that Integer’s 2017 orthopaedic revenue fell in a range between $190MM to $205MM. (Portable Medical is not included in the divestiture.) MedPlast is acquiring ~$400MM in sales and 10 manufacturing facilities. Integer will continue to supply MedPlast with ~$50MM of product that is manufactured at plants that are not included in the transaction.

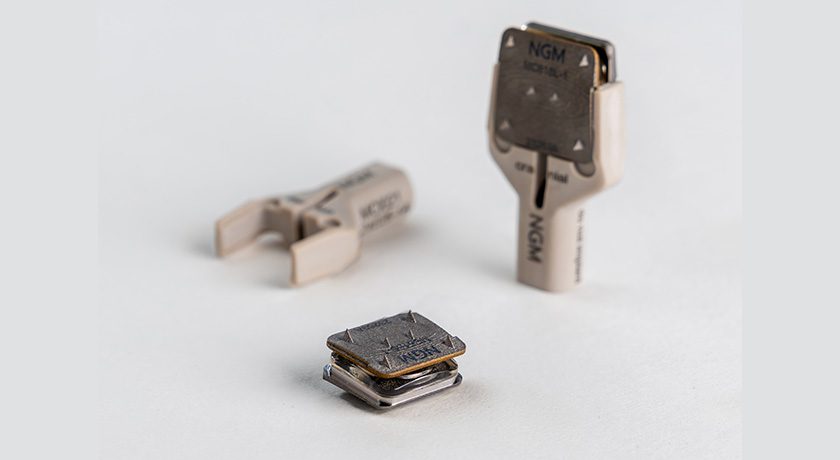

The ASO business comprises products and services for markets of laparoscopy, general surgery, biopsy and drug delivery, arthroscopic devices/components and orthopaedics. The latter two in particular include shaver blades/burrs, ablation probes, suture anchors, joint recon implants, fracture plates/screws, spinal devices, instruments and delivery systems (cases and trays). Integer’s customers have included Cardinal Health, Johnson & Johnson, Medtronic, Philips Healthcare, Smith & Nephew, Stryker and Zimmer Biomet. In 2017, the ASO division was developing a portfolio of single-use instruments and coated products for orthopaedics, and instruments for the robotics end-market.

MedPlast gains a range of metals manufacturing capabilities (e.g. machining, stamping, coating and metal forming), as well as design, development and prototyping services. Its presence will expand in Europe, where MedPlast’s Orthoplastics division, based in the U.K., produces UHMWPE-based components for knee and hip devices. MedPlast acquired Orthoplastics in 2013.

In 2017, MedPlast acquired Vention Medical’s Device Manufacturing Services and Coastal Life Technologies to extend its portfolio of services into assembly and packaging. In 2016, MedPlast partnered with Water Street Healthcare Partners and JLL Partners, strategic investment firms specializing in the healthcare industry.

Prior to this announcement, ORTHOWORLD had placed Integer among the top five contract manufacturers serving the orthopaedic industry, ranked by revenue: Tecomet, Orchid, Cretex companies, Integer and Rosler.

Integer’s exit from orthopaedics marks the second major M&A transaction in the ortho-serving supplier space for 2018, following NN, Inc.’s purchase of Paragon Medical. As noted in the latest version of THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT®, M&A activity will continue in the supplier space as tier-one manufacturers seek to remain competitive with other tier-one manufacturers, as well as with suppliers and service providers. Manufacturers will purchase companies with a strong regional presence (U.S., Europe, Asia, etc.) and companies with strong competencies outside of traditional manufacturing (coatings, design, regulatory, packaging). These investments will be financed in part by private equity firms that have recently entered or will enter the space, and will be assisted by tier-two and tier-three suppliers attentive to market dynamics and well-positioned to be purchased.

Sources: Integer, BONEZONE®, THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT®

Medical device outsource manufacturer Integer entered into an agreement to sell its Advanced Surgical and Orthopedics lines (ASO) to MedPlast, a global services provider to the medical device industry, for US $600MM in cash. The transaction is expected to close in 3Q18.

Integer was formerly known as Greatbatch, which included Greatbatch...

Medical device outsource manufacturer Integer entered into an agreement to sell its Advanced Surgical and Orthopedics lines (ASO) to MedPlast, a global services provider to the medical device industry, for US $600MM in cash. The transaction is expected to close in 3Q18.

Integer was formerly known as Greatbatch, which included Greatbatch Medical and Lake Region Medical orthopaedic products. In 2016, Greatbatch rebranded under the Integer name.

For 2017, Integer’s ASO plus Portable Medical reporting segment posted revenue of $439.8MM. Of that, ORTHOWORLD estimates that Integer’s 2017 orthopaedic revenue fell in a range between $190MM to $205MM. (Portable Medical is not included in the divestiture.) MedPlast is acquiring ~$400MM in sales and 10 manufacturing facilities. Integer will continue to supply MedPlast with ~$50MM of product that is manufactured at plants that are not included in the transaction.

The ASO business comprises products and services for markets of laparoscopy, general surgery, biopsy and drug delivery, arthroscopic devices/components and orthopaedics. The latter two in particular include shaver blades/burrs, ablation probes, suture anchors, joint recon implants, fracture plates/screws, spinal devices, instruments and delivery systems (cases and trays). Integer’s customers have included Cardinal Health, Johnson & Johnson, Medtronic, Philips Healthcare, Smith & Nephew, Stryker and Zimmer Biomet. In 2017, the ASO division was developing a portfolio of single-use instruments and coated products for orthopaedics, and instruments for the robotics end-market.

MedPlast gains a range of metals manufacturing capabilities (e.g. machining, stamping, coating and metal forming), as well as design, development and prototyping services. Its presence will expand in Europe, where MedPlast’s Orthoplastics division, based in the U.K., produces UHMWPE-based components for knee and hip devices. MedPlast acquired Orthoplastics in 2013.

In 2017, MedPlast acquired Vention Medical’s Device Manufacturing Services and Coastal Life Technologies to extend its portfolio of services into assembly and packaging. In 2016, MedPlast partnered with Water Street Healthcare Partners and JLL Partners, strategic investment firms specializing in the healthcare industry.

Prior to this announcement, ORTHOWORLD had placed Integer among the top five contract manufacturers serving the orthopaedic industry, ranked by revenue: Tecomet, Orchid, Cretex companies, Integer and Rosler.

Integer’s exit from orthopaedics marks the second major M&A transaction in the ortho-serving supplier space for 2018, following NN, Inc.’s purchase of Paragon Medical. As noted in the latest version of THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT®, M&A activity will continue in the supplier space as tier-one manufacturers seek to remain competitive with other tier-one manufacturers, as well as with suppliers and service providers. Manufacturers will purchase companies with a strong regional presence (U.S., Europe, Asia, etc.) and companies with strong competencies outside of traditional manufacturing (coatings, design, regulatory, packaging). These investments will be financed in part by private equity firms that have recently entered or will enter the space, and will be assisted by tier-two and tier-three suppliers attentive to market dynamics and well-positioned to be purchased.

Sources: Integer, BONEZONE®, THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT®

You are out of free articles for this month

Subscribe as a Guest for $0 and unlock a total of 5 articles per month.

You are out of five articles for this month

Subscribe as an Executive Member for access to unlimited articles, THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT and more.

JV

Julie Vetalice is ORTHOWORLD's Editorial Assistant. She has covered the orthopedic industry for over 20 years, having joined the company in 1999.